The Nuclear Option, Revisited

For another take on energy, see “The Nuclear Option in Oregon” by Robert Sack, M.D.

I’m always baffled by the neediness of nuclear advocates (I exempt Dr. Sack, who is less advocating nuclear than keeping an open mind to the option). They have to argue that their preferred electricity source is mistreated, its downsides exaggerated, its characteristics mischaracterized in innumerable ways by unduly harsh critics. The high costs and uncertain completion schedules of the past are not indicative of the future. The critics pile on whenever there’s a nuclear hiccup.

Disclosure: I cut my energy policy teeth in early-on fights to stop five mega-nukes in Washington State (the Washington Public Power Supply System, or – fun factoid – “WPPSS”). We stopped four of them, substituting for them an astonishingly successful prioritizing of electric energy efficiency (more on this below). I was also involved, as a Member of the NW Power Planning Council, in making the case to terminate Portland General’s Trojan nuclear power plant in 1993 rather than pump more millions into fixing its perforated water pipes.

So you might think I’m the perfect hit man to douse Bob Sack’s case for nuclear in core coolant. You’d be wrong.

Give me a choice of a new coal plant or a nuke, large or small, and I’ll opt for the nuke every time. The problems with nuclear energy are well catalogued (and hardly defanged by Dr. Sack despite a valiant defense), but none of them amount to parboiling the planet, the outcome we can plausibly expect if we keep burning fossil fuels.

But the choice isn’t coal v. nuclear, or fossil v nuclear. The alternative is finding the least cost way to meet electricity demands, including the escalating demands we’ll see as we electrify space and water heating and cars and trucks.

In a least-cost test, we also have to project forward, but conservatively, to what we expect the technology cost and efficiency curves of conservation and generation will provide us. We should be construing “cost” broadly to include environmental and other “externalized” costs – more on this below – but for now we can look to ongoing analyses by NREL, Lazard, the EIA, the IEA[2] and other credible sources.

What these sources consistently tell us is:

- new wind and solar not only beat the pants off new fossil and nuclear, but brand new wind/solar projects compete heads up with just the operating costs of existing such power plants (e.g., excluding recovery of their capital costs), and

- the cost curves of wind, solar and battery storage have been dropping for the last 20 years and more to get to this point, and are continuing to find cost reductions.

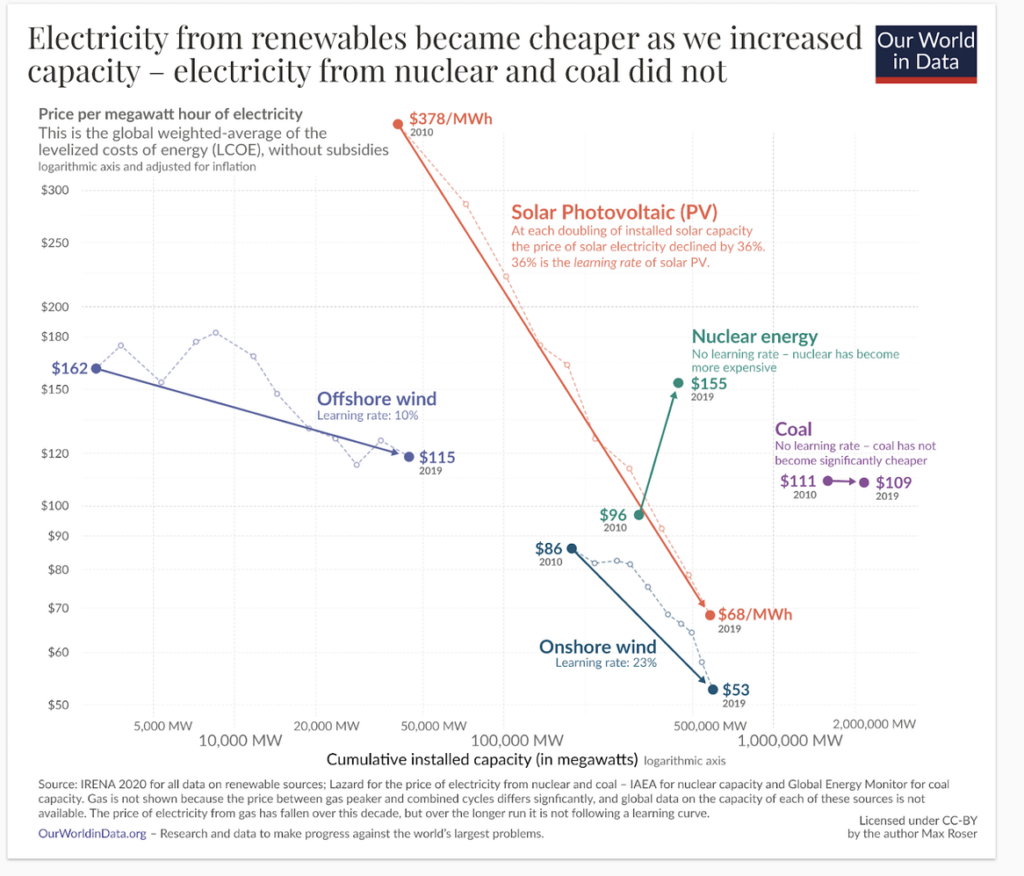

That some technology costs are declining while others are stuck or even rising is attributable to “highly predictable[3]” experience/learning curves that new technologies can capture, especially if they come in reproducible units (e.g., photovoltaic panels) that can constantly be tweaked for technological, production and installation cost efficiencies. Wind has found added cost efficiencies in scaling up its “units” from the early California 25 kW turbines to European offshore turbines pushing 7,000 kW of capacity, each one.

This has resulted in cost reductions just since 2010 , for utility-scale projects, of 85% for solar PV, 47% for wind and 65% for lithium battery storage.

In contrast, the only new nuclear facility in the US – Georgia Power’s Vogtle Units 3 and 4 – was approved in 2012 and slated to open in 2016. The combined cost for Units 3 and 4 was projected at $14 Billion. Unit 3 alone, opening seven years late, is costing over $34 Billion[4].

While nuclear power has had an uncertain history worldwide, we should note that there are important exceptions to the US nuclear experience of ever-increasing costs and interminable delays. In particular, South Korea has been able to leverage a standardized design, co-locating multiple units at the same site (only four sites for 26 units), and other techniques into a generally flat plant cost and above-average capacity and safety ratings. Nonetheless the country was unnerved by Japan’s Fukushima plant disaster and has ramped down its own nuclear ambitions including terminating several plants that were in the planning pipeline.

Unlike wind, the nuclear industry is looking for cost-effectiveness gains by scaling down from one-off-designed large plants to Small Modular Reactor (SMR) designs that can be factory-built, transported to site and installed in multiples of single units. It’s possible this will change the cost dynamics for nuclear. The NuScale reactor model that Bob Sack has put his modest pile of chips on has recently reported an increased projected cost of energy from $58/megawatt hour (MWH) to $89/MWH, substantially above the Lazard-tracked costs for solar (. $28 – $40) or wind ($26 – $50). NuScale’s first module is projected to begin commercial operation in 2029. Based on the history of nuclear energy, further cost increases and more distant timelines cannot be ruled out.

That’s a lot of uncertainty and cost risk nuclear brings when it demands a seat at the decarbonizing table.

Dr. Sack correctly notes that wind and solar have their own drawbacks, chief among them the “intermittent” nature of their production, dependent on the wind blowing and the sun shining. But we have long had a similar “intermittency” issue here in the Northwest, relying on hydroelectricity that varies with seasonal changes in rainfall, snowpack and river flow, all of which can swing widely from year to year. How do we mitigate this? We have energy storage in the form of water held behind dams (and snow in snowpack) that can be released as our power needs demand.

Similarly, we are having to develop hourly and daily energy storage for wind and solar generation. For now that’s mostly the same lithium-based battery technology that’s in your iPhone and your Tesla battery, but it’s scaling up to hybrid solar-storage utility projects[5] like the one PGE has operating in north-central Oregon. Plausible future storage concepts include longer-duration storage (lithium is usually limited to a 4 hour cycle), lower cost and more available battery materials (like iron+salt+water “flow” batteries with 100 hour cycles), and using surplus renewable generation to convert water to hydrogen and oxygen, then storing the “green” hydrogen for conversion back to electric energy.

Add to these utility-based batteries another concept: a two-way linkage between our electric homes and vehicles, and the grid that will allow EV owners to sell to the utility, on terms that assure we reserve the driving range we need, the balance in our batteries of this always-available “distributed” storage. In the future, residential/commercial loads like hot water tanks, will also have this option widely available.

Other concerns raised by Dr. Sack – land use; access to transmission – are common to many energy enterprises we undertake (think dams interrupting river traffic and fish migrations; long-distance transmission linking remote dams to our cities and towns). At our best, we solve these challenges with innovative ideas like covering roofs with rolls of solar generating film that also keep the rain out; or parking lot awnings that produce electricity while shielding us from winter rains or summer sun.

We’ll need more transmission no matter the generating technology in order to capture system efficiencies by sharing seasonal and moment-to-moment surpluses and shortages across the grid – ultimately, across a continental grid. The Northwest has done this kind of sharing with California and Arizona since the NW-SW Intertie powered up in 1970, but it becomes imperative to fully develop grid efficiencies as we diversify our system and incorporate more variable generation resources.

We’ll also need continued development of more efficient grid management technologies and of lower-resistance transmission core materials.

Finally, is there enough renewable resource out there to power our decarbonizing and electrifying region? A good answer is both easy and hard to give, since technologies to capture wind and solar are evolving faster than the studies can catch up. But to illustrate: the current installed wind capacity in the US is about 35 Gigawatts (GW)[6]. NREL projects total US on-shore wind potential using now-available 80 meter hub height turbines at almost 10,500 GW, most of it in the less-populated center of the country from Texas north to the Dakotas and Montana[7].

By comparison, the four Pacific Northwest states today use about 43 GW of electricity. Total US electricity demand in 2021 was 1,146 GW.

That’s just onshore wind. Offshore wind capacity[8] is harder still to gauge. Globally there is around 50 GW of installed offshore wind, most of it on fixed foundations in the relatively shallow waters of the North and Baltic Seas but with early projects also off the US Northeast coast. The west coast, with its deeper offshore waters, will require still-emerging floating turbine technologies that are now being deployed commercially off British shores.

National Renewable Energy Laboratory (NREL) projects solar photovoltaics installed in accessible US sites is capable of powering 45% of our electricity demand in 2050 assuming the total energy system is decarbonized and electrified … and efficiencies in buildings and equipment are broadly realized.

Let me offer a more general observation, one that our region has observed to our advantage since the passage of the Northwest Power Act of 1980. In that Act of Congress is embedded the concept of “least-cost” electricity, broadly defined. That is, our utilities should be shaping their power resources from the lowest cost choices available at the time of purchase, being mindful of the value of resource diversity. In our planning, “least cost” is defined to include economic “externalities.” These are costs imposed on all of us by individual, corporate or government choices that are not captured in the market price of the good produced. The foremost example of an “externality” would be pollution from a factory or power plant that injures downwind communities and households, where the plant owner is not held responsible. These health and other costs are imposed on others without them agreeing to suffer the injury.

Global climate disruption and its effects – fire, flooding, drought, extreme weather, incidence of disease, and so on – are externalities imposed on us all by the combustion of fossil fuels. In the absence of demanding that the plants (and we as individual consumers) pay the costs of the disruption, the costs are externalized to us all.

The Power Act of 1980 required analysis of both market (internalized) and externalized costs, and then directed utilities to choose the least cost option.

In the forty-plus years we’ve been applying this standard for selecting electric power resources, the priority least cost option has consistently been energy efficiency (before 1980, efficiency had been dismissed as an afterthought in utility planning; a “personal virtue” per Dick Cheney). This “resource” – insulation, efficient lighting and heating and so on, saving money by avoiding the costs of building and operating a new power plant – is now the second-largest resource in the region, after hydroelectricity but creeping up toward three Grand Coulee dams worth of savings, usually at costs a half to a third what a new power plant would cost. Oh, and carbon-free.

So if wind, solar, storage and energy efficiency are fully mobilized, while nuclear technologies and costs remain uncertain and consistently higher than these other carbon-free options, why even keep nuclear options in the mix?

The short answer is that life is uncertain, technologies sometimes surprise, and the imperative to displace fossil fuels is critical. Keep researching and testing nuclear technologies, including both fusion and SMRs. On these points Dr. Sack and I agree. But don’t plan to deploy them as long as lower (total) cost options are available to us.

[1] Angus Duncan is Member and Chair Emeritus, Northwest Power Planning Council; Member and Chair Emeritus, Oregon Global Warming Commission; Former President and CEO, Bonneville Environmental Foundation

[2] NREL: National Renewable Energy Laboratory, at https://www.nrel.gov ; Lazard Freres Annual Levelized Cost of Energy Analysis (LCOE 15.0) at https://www.lazard.com/research-insights/levelized-cost-of-energy-levelized-cost-of-storage-and-levelized-cost-of-hydrogen-2021/; International Energy Agency; Energy Information Administration, US Department of Energy at https://www.eia.gov/electricity/

[3] “Make the Clean Stuff Cheap,”, Beinhocker, Farmer; November 10, 2021; https://www.inet.ox.ac.uk/news/report-a-new-perspective-on-decarbonising-the-global-energy-system/

[4] https://apnews.com/article/business-environment-united-states-georgia-atlanta-7555f8d73c46f0e5513c15d391409aa3

[5] . . . like PGE’s already-operating Wheatridge Wind+Solar+Storage facility – respectively 300 MW, 50 MW and 30 MW – in Morrow County, OR (https://portlandgeneral.com/about/who-we-are/innovative-energy/wheatridge-renewable-energy-facility)

[6] One Gigawatt = 1000 Megawatts = 1,000,000 kilowatts.

[7] https://www.nrel.gov/docs/fy11osti/50860.pdf

[8] https://www.nrel.gov/wind/offshore-market-assessment.html

Comments, thoughts or questions? Email us now!